Using AI for Win/Loss Analysis

Aug 29, 2024

Written by

Andrew Luo

Teams of all sizes, from startup to enterprise, are increasingly adopting win/loss analysis programs. The main goal is to collect unbiased & unfiltered feedback from buyers and use it to improve product, positioning, sales processes, and more.

Some possible questions that a successful win/loss program can answer:

Was our pricing too high or too low?

Why is our win rate higher among VSBs but falls when we look at SMBs?

Why did we lose to competitor [X]

In this write up, we’ll go over the basics of a win/loss program and how AI can streamline certain processes.

Basics of win/loss analysis

Win/loss analysis is looking at past deals and understanding why they were won or lost. By analyzing feedback, teams can make changes to improve the win rates. Feedback can also be broken down by industry, market segment, or competitor. This way teams can create specific playbooks for the next similar opportunity and not make the same mistakes.

A win/loss program usually consists of collecting data, extracting insights, and taking action based on the learnings. For example, if a team is consistently losing to competitor [X], they could emphasize their advantage over [X] in future battle cards and pitch decks. If a team lost because they are missing a certain integration, it could get prioritized on the product roadmap.

What makes up a win/loss analysis program?

There’s no one size fits all program for win/loss. This is meant to serve as a rough outline that a team can draw inspiration from to design their own program.

Collecting data

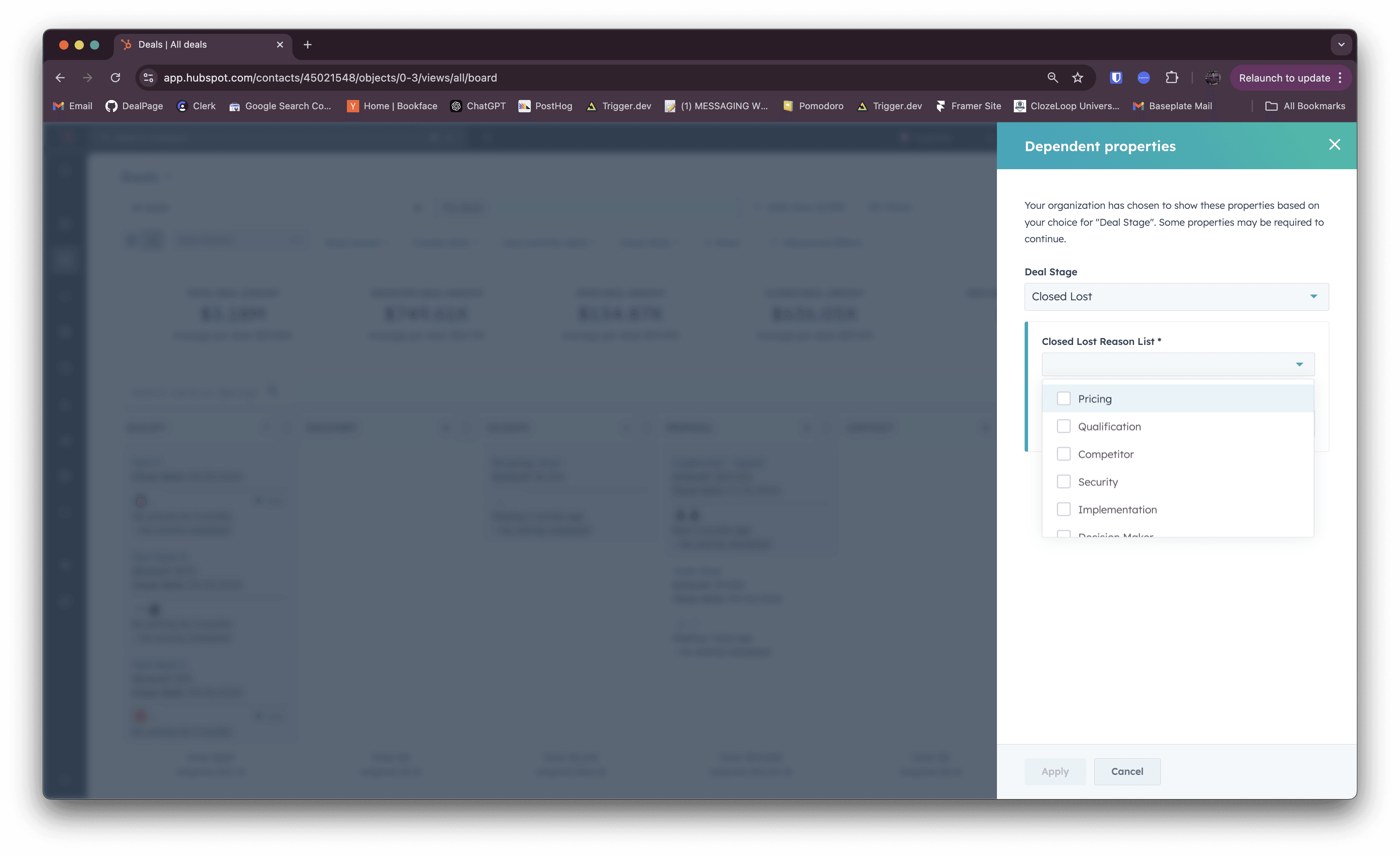

There is likely both internal and external data for each deal. Internal data might include internal discussions in Slack, CRM notes in Salesforce, or meeting transcripts from Gong. These provide one side of the picture when it comes to analyzing win/loss. External data is collected directly from buyers, usually as a survey or interview. When done by a third-party, these sources tend to be more unbiased and honest.

The data captured at this step may be qualitative (meeting transcripts), or quantitative (deal size, win rates). Both can be used to structure your win/loss program.

One potential use for AI at this step is to automatically build personalized surveys based on what was discussed in emails and calls. For example, if pricing was heavily negotiated over a long email thread, the AI could include more questions about price and how it played a role in the decision.

Another potential use case (although the models aren’t quite there yet), is actually having an AI voice agent and avatar conduct the live interview. We’ve seen a few companies working on real time conversational interfaces, but they still have an uncanny valley feel and may only be able to ask basic questions based on instructions.

Extracting insights

After collecting internal & external data, they should be aggregated into reports and actionable insights.

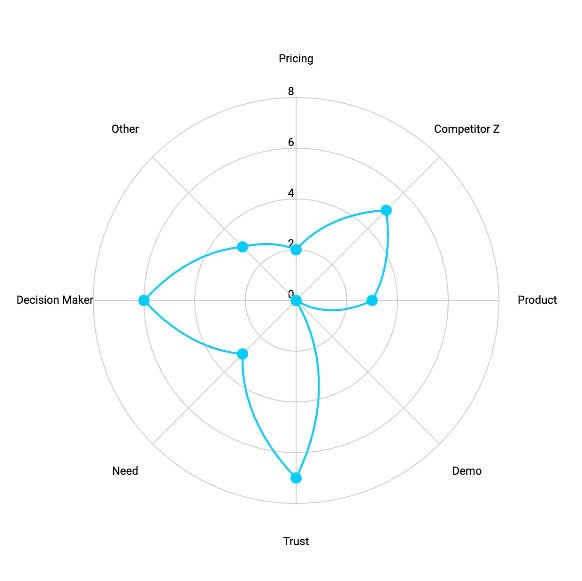

Most quantitive data can be presented as charts to get a better understanding of win rates by segment. You could see which verticals / personas you have the most success with vs which you are struggling with. AI is notorious bad at math and calculations, so we would advise trying to apply it in any way here. Traditional data analysis will be your friend, and there are plenty of existing solutions. The one case where it might be useful is creating custom views and charts, since it’s natural language to database query capabilities are usually decent.

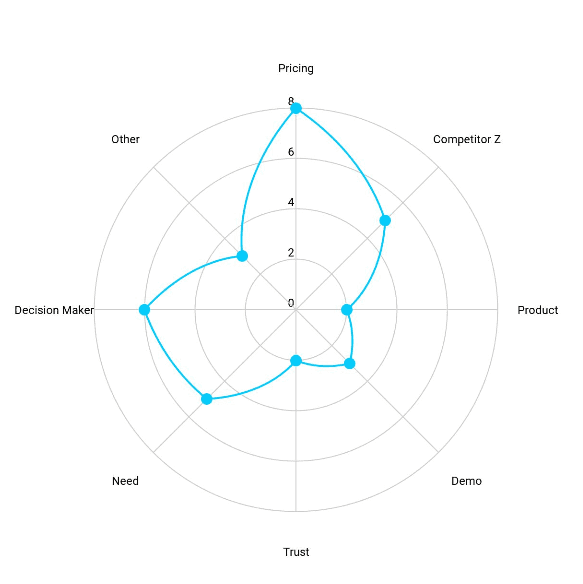

Qualitative data is where you can apply some of the strengths of AI. It’s good at summarization, extraction, and classification. For example, given a list of 8 possible loss reasons and a transcript of an interview, it could reliably extract which of the 8 reasons were mentioned. We would still recommend having it cite the quote and having a human check it.

One useful insight is internal loss reasons vs. external loss reasons.

Taking action

Usually after viewing analytics on where the product or sales process can be improved, win/loss programs implement playbooks or create collateral to help address weaknesses.

Creating collateral usually involves taking the top N competitors you are losing to, and positioning your solution as a better alternative to them. You can address in battle cards what features they are missing and where you beat them. AI can be used to generate copy, or provide suggestions on what to edit on your battle cards.

We caution using AI for actually recommending actions or predicting future outcomes. While some suggestions may sound valid, they might be hallucinations, which are made up assertions that are not grounded by facts.

AI’s role in win/loss

There are several ways AI can make your win/loss program more efficient. It can save time by creating custom surveys, extracting info from qualitative data, and generating suggestions for editing collateral. However, it’s still at this current time (Aug 2024), somewhat prone to errors and should be double checked.

We might see a world in the future where most of the process can be automated.